In December 2021, the Federal Government created the temporary Small Business Air Quality Improvement Tax Credit. This Tax Credit aims to improve the air quality in the work environment. This tax credit is available until the end of December 2022 but may be extended.

Qualifying expenditures

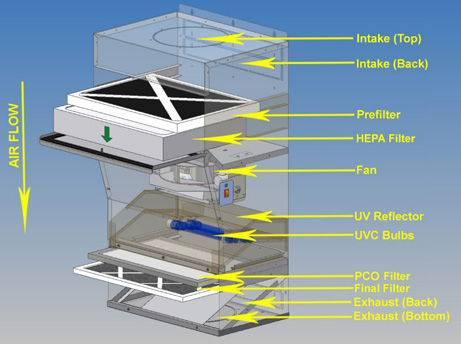

Qualifying expenditures “must be related to the purchase and installation of mechanical heating, ventilation, and air conditioning (HVAC) systems. They also include expenditures to upgrade or convert existing systems and the purchase of devices designed to filter air using high-efficiency particulate air (HEPA) filters. The primary purpose of the HEPA filter should be to increase outdoor air intake, or to improve air cleaning or air filtration.”

In other words, any upgrades that filter the air via HEPA filtration, or increase the amount of outdoor air supplied to the indoor space.

Eligible entities

This credit is for small businesses. Sole proprietors and incorporated companies. Your corporation’s taxable capital must be less than $15 million in the previous year.

If you’re unsure if your organization qualifies, you should check with your tax professionals.

Required specifications of equipment

Expenses attributable to an HVAC system will only be considered qualifying expenditures if the system is:

- designed to filter air at a rate surpassing a Minimum Efficiency Reporting Value (MERV) of eight; or

- designed to filter air at a rate equal to MERV eight and to achieve an outdoor air supply rate in excess of what is required for the space by relevant building codes. For a system that is upgraded or converted prior to the improvement, the system must have been designed to filter air at a rate equal to MERV eight.

Restrictions

The proposed credit will have certain restrictions such as:

- The expenses cannot have been made or incurred under the terms of an agreement entered into before September 1, 2021.

- Expenses for routine repairs and maintenance will not qualify, nor will financing costs related to qualifying expenditures.

- An expense that may be considered a qualifying expenditure will be reduced by the amount of any government assistance received by the eligible entity in respect of that expense.

Qualifying locations

Qualifying locations will be properties used by a claiming taxpayer primarily during its ordinary commercial activities in Canada (including rental activities), provided such a location is not a primary dwelling.

Timing

The proposed tax credit is to be available with respect to qualifying expenditures incurred between September 1, 2021 and December 31, 2022. However, for expenditures incurred before January 1, 2022, the tax credit claim could not be until the first taxation year of the claimant which ends on or after January 1, 2022. This would mean the 2022 tax return for a calendar-year taxpayer.

Though, for qualifying expenditures incurred on or after January 1, 2022, they could be claimed for the taxation year in which the expenditure was incurred. As always, if you are unsure, you should consult your tax professionals.

How Can Breathe Better Help?

Its in our name. Breathe Better Indoor Air Quality Specialists are the sole distributors of the Pur Distribution Air Purifiers. Coming in a range of fix duct, mobile, HEPA and UV lighting combinations, Breathe Better has the equipment to help you and your colleagues, Breathe Better at work. Call us today for your free consultation and quote!

Services Offered:

- Residential and commercial furnace and duct cleaning

- Residential and commercial dryer vent cleaning

- Furnace Filter Maintenance

- Coil Cleaning

- Disaster/Emergency Remediation

‘Indoor Air Quality Specialists Helping You To Breathe Better.’

Breathe Better Indoor Air Quality Specialist Is a Trusted Saskatoon Furnace, Duct & Vent Cleaner!